You should initially buy Responsibility or Complete Coverage insurance and the price will depend on your age, driving document, kind of automobile, and added insurance coverage elements. Be certain to get in touch with United Vehicle Insurance policy for a quote on the lowest price.

United Auto Insurance coverage is the vehicle insurance business here to aid you with your automobile insurance coverage requires. Commitments are satisfied, the SR-22 status will certainly be removed. At that time, it will be important to review your insurance with United Car Insurance and also make sure that you proceed to remain covered.

United Automobile Insurance is below for you on the occasion that you require an SR-22 certificate as well as insurance coverage plan. Poor points can take place to great individuals, so we recognize that having the appropriate team on your side to help you clear up any kind of blunders is essential. The best method to handle an SR-22 requirement View website is to call us faster as opposed to later to stay clear of any higher dangers and understand that you are covered.

This details is indicated for instructional functions and also is not intended to replace info gotten with the estimating procedure. This details might alter as insurance plan and protection modification.

The Definitive Guide for Tx Sr22 Insurance - Same Day Filing.progressive - 512-339 ...

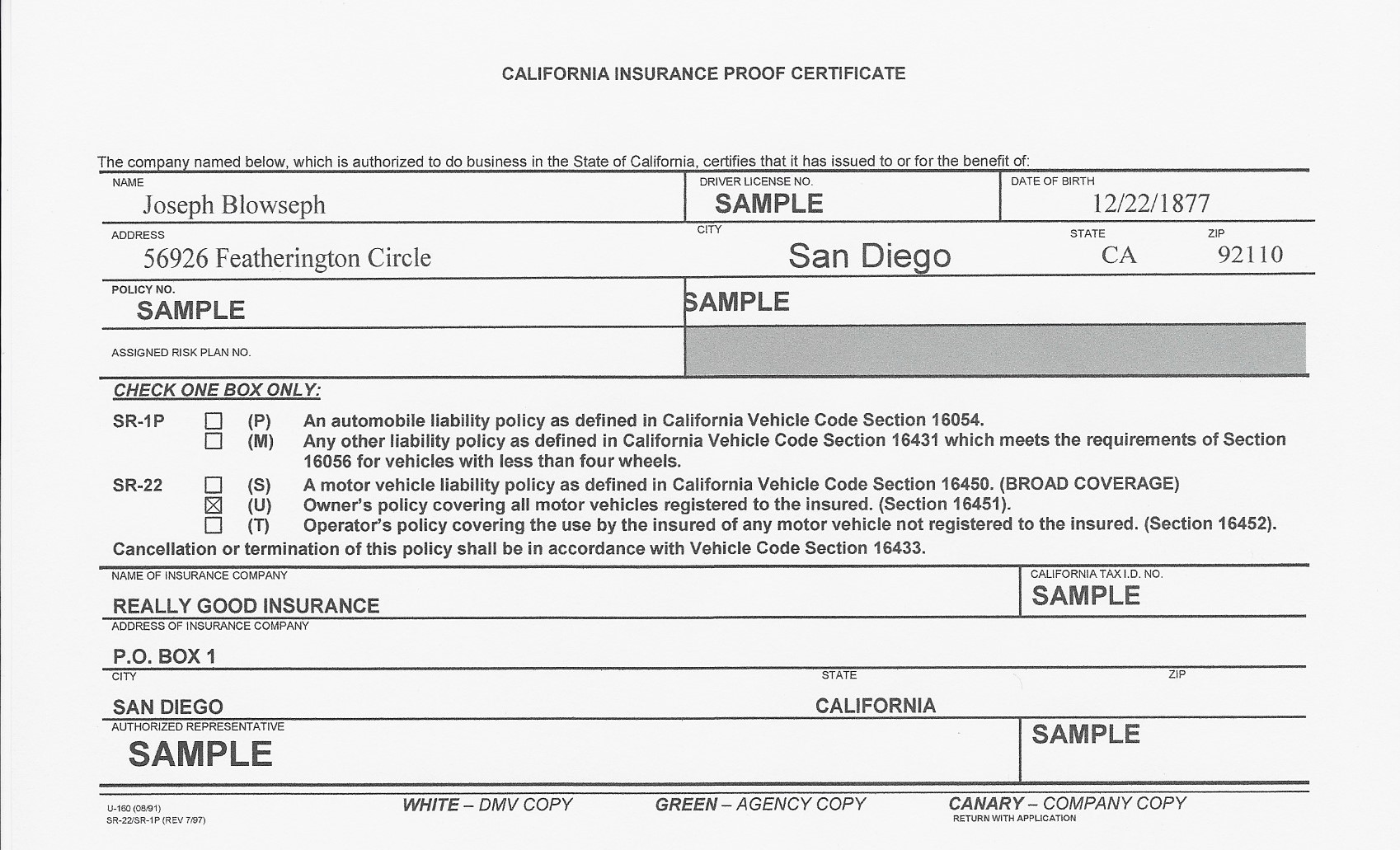

Fewer business will supply insurance policy. Ask your representative to file the SR-22 or call the customer support number at your insurance provider. They will certainly take treatment of it for you. The SR-22 certification is filed directly with the state by your insurance firm. Infinity bills a fee to submit this form.

If you filed for an SR-22 in one state as well as relocated to a various state, you still need to fulfill the demands of the SR-22 where the offense took location. Search for an auto insurer that operates across the country, so you don't face problems when you relocate somewhere else. There are some states that don't use an SR-22 certificate.

Despite where you live, Infinity Insurance policy can help you with your auto insurance coverage needs if you've been billed with a DUI or need an SR-22/ FR-44. Speak to one of our pleasant representatives at, and we'll be pleased to aid.

The time framework can range from two to five years, depending on your state and the factor you need an SR-22. The SR-22 will continue to be valid as long as your vehicle insurance policy is active.

The Basic Principles Of What Is Sr22 Insurance? - Sr22 Insurance Quotes - Free ...

Your license will be put on hold, and also this time structure won't count towards the mandated filing duration. For instance, if you're called for to have the SR-22 for 3 years however cancel your insurance after one year, then your certificate will certainly be put on hold. As soon as you reinstate your insurance coverage as well as license, the clock begins again as well as you'll require to have the SR-22 on declare another two years.

Does SR-22 insurance policy cover any kind of cars and truck that I drive? Yes, just like typical car protection, SR-22 insurance will certainly cover you in any kind of auto you drive. However, if you do not possess an auto, you must obtain, which does cover you in any cars and truck you drive but obtains a little much more complicated when it involves whose insurance spends for what if you need to make a case.

While SR-22 insurance policy generally runs out after 3 years, the period can vary based on your driving record and the state you stay in.

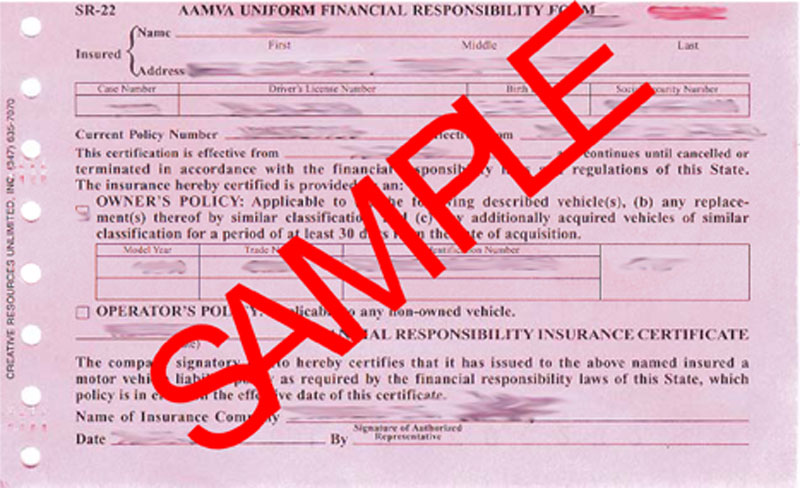

If it's court-ordered, the court would certainly alert you during your hearing that you are required to obtain it. If it's state-ordered, usually, you would get an official letter in the mail from the Department of Motor Cars that you are needed to obtain an SR-22. This 'Certificate of Financial Duty', isn't a kind of insurance policy, but instead a record offered by your insurance coverage company that highlights that you have liability protection on your car insurance plan.