Even if you're a secure motorist, you haven't been driving enough time for the insurer to know, and also your absence of experience will certainly result in greater rates. Fortunately is that if you're a teen or a brand-new chauffeur, your insurance prices will tip over time until you turn 25, or till you have a number of years of secure driving under your belt (more on this later).

Once they officially relocate out, nonetheless, they'll need their own different plan. Another perk: if you are including an automobile in addition to a motorist, you might get a multi-car discount rate for guaranteeing a number of automobiles. Maintaining a tidy driving document is among one of the most essential steps you can take towards more cost effective prices.

The Where Can I Get Cheap Auto Insurance For My Old Car ... Diaries

Dropping compensation as well as crash suggests you will not obtain anything if the cars and truck is damaged or amounted to, yet removing your auto insurance coverage to simply the fundamentals like responsibility insurance coverage as well as underinsured/uninsured driver insurance coverage can significantly lower your costs. Another proven means to guarantee you're obtaining the very best prices out there is to look around for insurance coverage from numerous providers, do a complete quote contrast and then select the vehicle insurer that can provide one of the most coverage at the most affordable cost.

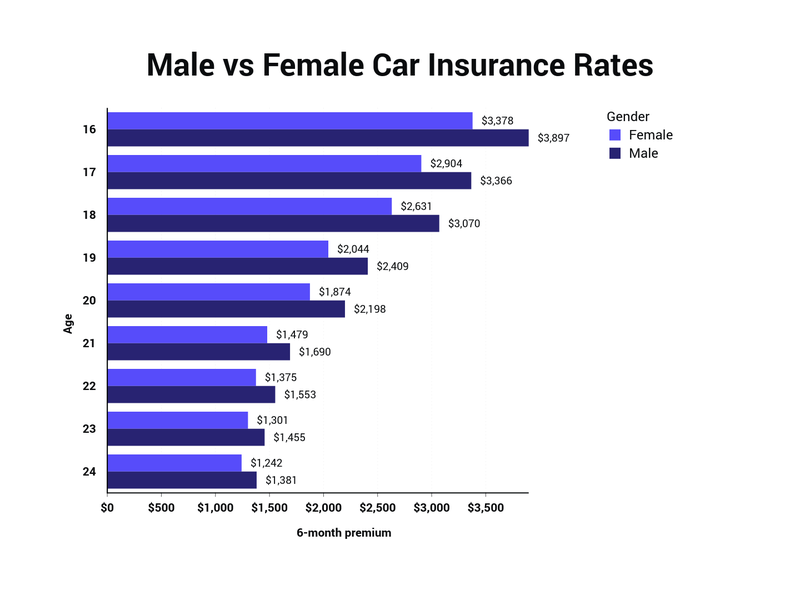

Young vehicle drivers that obtain their very own policies can also bundle their cars and truck insurance with an occupants insurance coverage for a multi-policy discount. As we pointed out above, teenager and young person drivers usually pay higher prices for vehicle insurance policy. Usually, the more youthful the driver, the more expensive it will be for them to obtain car insurance protection.

Unknown Facts About How Is My Car Insurance Calculated? - Confused.com

For newer cars and trucks, you would definitely have better security features such as anti-theft mechanisms, air bags, and also the like. car insurance. Again, with newer autos, the value of the automobile is also significantly greater than that of older autos.

Think about it this way a brand-new Corvette would most definitely be a lot more costly than your old Chevy family members cars and truck. Why wouldn't the insurance policy company charge more for the newer and also extra expensive car?

If You Own A Car That's More Than 10 Years Old, It May Be ... Can Be Fun For Anyone

As such, vehicles that drop under these 2 classifications would certainly have higher responsibility premiums. One more very crucial element that can reduce the price of insurance for older vehicles is the sort of insurance coverage. In some cases, it would be more price reliable for the owner of an older automobile to simply change it in situation of an accident.

In this case, the only coverage that would be required is 3rd celebration insurance coverage. Thus, the price of the vehicle insurance would certainly be dramatically reduced than if other kinds of protection were to be obtained as well. Of program, the cost of your auto insurance policy does not absolutely depend on your cars and truck's make and version.

Some Known Factual Statements About Is Car Insurance More Expensive For New Cars? And ...

Whether you have an old auto or a brand-new car, you ought to always exercise secure driving.

As the moms and dad or guardian of a young motorist, you recognize it's important to have good automobile insurance policy to protect them. Whether you're paying for it or they're striving to pay the bill, it's a new expense for your family. Fortunately, you can locate inexpensive vehicle insurance policy for young drivers without breaking the financial institution.

The Liability Only Car Insurance - Coverhound Ideas

Nevertheless, if your teenager does have a deluxe vehicle, it may be cheaper for Helpful hints them to be by themselves automobile insurance plan, because opportunities are the insurance costs will certainly be considerably higher than various other automobiles within your policy. It may also make more feeling for them to acquire their very own policy if either moms and dad has any kind of DUIs or multiple relocating infractions, as adding a teenager vehicle driver can make the current policy cost even a lot more.

While doing so will certainly raise your insurance rates, your plan's protection and deductibles will certainly additionally apply to your teenager. You might additionally be able to save money by signing up for a multi-car insurance plan. A higher auto insurance policy deductible may reduce the rate, but could imply much more out-of-pocket costs after an accident.

Not known Details About Classic Car Insurance - Get A Quote From Agent - State Farm®

Obtaining the ideal coverage that best fits your demands is very important for saving money on your teen's cars and truck insurance coverage. Learn extra regarding Nationwide's car insurance policy protection kinds today.