Homeowners with lower credit report will see higher prices. And also if you filed several insurance claims in the past or your home has a background of structural damages, your insurance rates will likely be greater. Homeowners insurance coverage price cuts vary by company, though here are a few of the most popular ways to save when you purchase a policy through Policygenius: Residence and auto packing price cut.

Stick with the exact same insurance coverage firm for five or even more years, and many insurance firms will offer you a discount rate for your loyalty. Army or other affiliation price cut. Home owners that are professionals, military members, or operate in a certain occupation (like educators or civil servants) could be able to snag a discount.

This consists of every little thing from when your residence was built and any current updates made to what type of roof covering and outside walls you have. homeowners policy. Pin down your insurance coverage restrictions. You'll want to make sure your policy limitations are high sufficient to pay for a full restore of your home, and that the deductible deal with your Click here for info budget plan.

Policygenius has conserved buyers a standard of 35% per year on their house and also car insurance coverage contrasted to their previous plans. One of our experts will aid you contrast plans and discounts across business to find the best coverage at the best cost - a home.

The Definitive Guide to What Does Homeowners Insurance Cover? - Marketwatch

A Policygenius agent will certainly walk you via each to assist you locate the very best insurance coverage limitations, attachments, and also price cuts for your demands. for home owners insurance. Where can I discover every one of this info for my quote? You must have the ability to find the majority of these details provided on your old house insurance plan's affirmations page.

Not all plans in this calculation are available in all states, and also schedule might be based on qualification. Cost savings may vary by policy amount and also location. House: $300,000 Various other frameworks: $30,000 Personal effects: $150,000 Loss of usage: $60,000 Responsibility: $300,000 Medical: $1,000 Often asked concerns, What is a residence insurance policy quote? A residence insurance quote is an of just how much you'll pay for a plan based upon information regarding your residence, credit history, asserts history, as well as coverage restrictions.

lowest homeowners insurance insurance claims homeowner insurance cheaper insurer homeowners

lowest homeowners insurance insurance claims homeowner insurance cheaper insurer homeowners

Which insurance firm is best for house owners? There's no one-size-fits-all residence insurance firm for any individual. You'll intend to locate a business that supplies policies in your state, and also contrast quotes to pick the one that supplies the protection you need at the most cost effective price. Search for companies that use discount rates, like money off for bundling your residence and car insurance coverage.

Most lending institutions will require evidence of house insurance before you can shut on a residential property.

Facts About Choosing Your Homeowners Insurance Policy Uncovered

Exactly how do you want to learn concerning homeowners insurance policy? Home owners insurance policy is required for everybody that has a home mortgage. liability insurance. It additionally may cover the components of your residence and also give individual obligation insurance coverage.

Am I legally called for to have house owners insurance coverage, like states need vehicle insurance policy? Unlike auto insurance policy, you are not needed by regulation to have a specific quantity of coverage for your house. If you're repaying a home mortgage, nonetheless, the loan provider may require you to have property owners insurance to protect the building from unanticipated damages.

How much house owners insurance protection do I require? The ideal way to discover just how much protection you may require is to conduct an appraisal. Along with working with your Mercury representative, we advise working with an independent and also qualified expert every numerous years to determine the expense to reconstruct your house with comparable high quality materials.

About What Does Homeowners Insurance Cover?

deductibles homeowners policy homeowners policy liability insurance affordable insurance

deductibles homeowners policy homeowners policy liability insurance affordable insurance

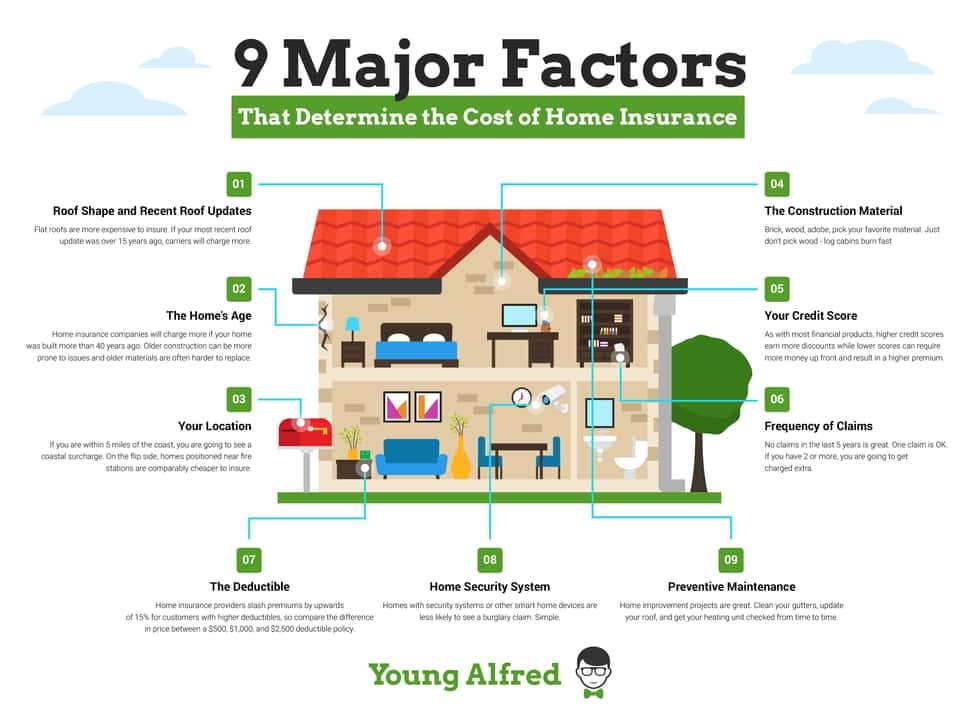

The majority of insurance providers will establish the premium quantity after assessing certain threat variables, such as distance to a fire house, alarm system, closeness to disaster area or quake faults and also age of residence, which permit them to figure out whether it is basically likely that the home will certainly be harmed or ruined.

Your residence is just one of your most valuable assetsso it makes good sense that you would certainly desire to maintain it well-protected. That's where the right homeowners insurance plan is available in. We understand that insurance can seem monotonous and completely dry (despite the fact that it's genuinely outstanding) - cheapest homeowners insurance. And also chatting concerning the complexities of your homeowners plan most likely isn't high on your list of "Things To Do After the Pandemic Mores than." An astonishing portion of people don't actually understand what their home owners policy covers as well as what it doesn't.

It additionally covers your belongingsfrom your bicycle to your laptopeven when you're not at residence. It additionally has your back when it comes to accidents on your residential or commercial property which may lead to legal action. We'll break down all the important things homeowners insurance covers in simply a sec. The major reason to obtain homeowners insurance coverage is well, because you most likely have to.

(Protection A) is the focal point of a house owners insurance plan. If your physical home is harmed or destroyed, dwelling protection can aid cover the costs to repair or also reconstruct it.

What Does Homeowners Insurance Cover? - Marketwatch Fundamentals Explained

Maintain in mind, however, that you will not have the ability to submit an insurance claim if those things just quit workingif your Mac, Publication dies, that's between you and Apple. If your Mac, Book is damaged in a fire, or is stolen, your home owners insurance policy comes into play - cheap homeowners insurance. Coverage C also travels with you when you leave your home.

In this situation, your Clinical Payments Coverage (Protection F) will aid foot the expense (pun intended). This component of your plan assists cover medical expenses up to $5,000 for visitors on your property, whether or not you're responsible for what triggered them to be harmed.

In this case, you can easily add them as an additional insured for an extra price. When acquiring a house insurance plan, it can be tempting to select the lowest protection choices, because that leaves you with an extra cost effective costs. That may be great if disaster never ever strikes, however when it comes to covered damages, you could regret your decision to squeeze pennies.

deductible a home owners insurance low cost homeowners insurance homeowners policy affordable insurance

deductible a home owners insurance low cost homeowners insurance homeowners policy affordable insurance

(If you require a tip of what each of these coverages involves, click below.) (Cov A) Your residence insurance coverage must cover the home's Repair Expense (RC), the price of restoring your house from the ground up. If the worst were to occur and your house were entirely damaged, you would certainly intend to have adequate insurance coverage.

The Definitive Guide to Homeowners Insurance Terms And Definitions - Grinnell Mutual

In various other words, this protection helps spend for things like an emergency room check out to establish a broken leg after an accident. You can set this protection in between $1,000 as well as $5,000. If you're often organizing events as well as gatherings, it may make sense to decide for the higher end of the variety - for home.

States that rest on the path of Twister Alley, like Oklahoma as well as Kansas, additionally often tend to have more expensive premiums. The states with the cheapest insurance coverage rates are mostly in the western USA, where natural disasters like typhoons, tornadoes, as well as hail storm are typically much less constant. Prices gets pretty granular. Not just will your state impact your insurance premium, however your exact address will, too.

If you live in a location with a reduced crime rate, costs are likely to be reduced than in an area with more crime (this makes sense, thinking about that burglary as well as criminal damage are covered dangers). The state of your house itself will certainly affect your home insurance costs. Ask yourself these these inquiries: How old is your building? Have you changed the roof covering lately? What sort of remodellings has your home been with? That pre-war crown molding may be your favorite point concerning your home, yet are the pipelines as old as the ceiling? That can be negative news come winter months.

There's no right or incorrect response. At the end of the day, select what makes feeling for you. We've already reviewed just how much coverage you most likely requirement for each of the primary six coverage groups, but it bears duplicating: The amount of protection you pick has a direct effect on just how much you'll pay on your month-to-month premiums.

Some Ideas on Homeowners Insurance Guide: Everything You Need To Know You Need To Know

Unlike car insurance policy, which is needed by legislation if you drive, house owners insurance policy is not called for just by merit of the fact that you're a home owner. Nevertheless most home mortgage loan providers will require a minimum of some standard kind of property owners insurance policy. As well as unless you got your house with money, you probably have a mortgage.

Homeowners Insurance policy is to shield from things that can harm your house and individual possessions. Not just does property owners insurance shield throughout an inclement weather occasion, but the plan can offer coverage for injuries that happen on your residential or commercial property as well as lawsuits against you - lowest homeowners insurance. Whether you have or rent out, there are different packages of residence insurance used to safeguard your home and also possessions.

* Customers who pack vehicle and also house insurance coverage policies might conserve as much as 23% on both policies together (since October 2021). Price cuts might differ by state, home, policy kind as well as company financing the automobile and/or home plan - homeowners. Price cuts may not use to all coverages on a car or building plan.

deductibles insurance discount insurance a home insurance premium

deductibles insurance discount insurance a home insurance premium

Some coverages may not be readily available in your state. insurance. Readily available at revival for existing policyholders. Please talk with your agent for more information about your protection options. This coverage is not readily available in MN currently.

How How Does Homeowners Insurance Work? - U.s. News can Save You Time, Stress, and Money.

Some home owners insurance coverage policies cover living costs while your residence is being reconstructed from damages. The expense of house owners insurance can differ on your protection.

It's a great concept to create a supply list of a few of your products with photos. This will make filing an insurance claim for reimbursement less complicated. When you have a home mortgage, you typically pay for your house owners insurance into your escrow account as well as your lending institution pays the premiums when they come due.

You can monitor what is as well as isn't covered on your plan on the home owners insurance statement page - insurer. What is flooding insurance coverage? Flood insurance coverage is similar to property owners insurance except that it only covers damages because of flooding. Flood insurance policy offered by insurer is also called private flood insurance.

FEMA mentions that an occasion is qualified as a flooding if "an unwanted of water ashore that is generally dry impacts two or more acres of land or more or even more residential properties. inexpensive." What is the National Flood Insurance Policy Program? The National Flood Insurance Program (NFIP) supplies standard flooding insurance policy protection and is backed by FEMA.

The Basic Principles Of Idoi: Property Insurance - In.gov

FEMA supplies flooding maps on their site that can inform you which areas go to the greatest danger of flooding. What does flooding insurance cover? Flooding insurance likewise has similar coverage as property owners insurance. It normally breaks down into 2 groups: building coverage and also contents protection. Building coverage protects your house and also Electrical as well as plumbing systems Water heaters Appliances like refrigerators, ovens and also dishwashing machines Permanently installed carpeting, closets, paneling, as well as shelfs Window blinds Foundation wall surfaces and also staircases Garages Gas containers, well water tanks Solar power devices Contents coverage protects your possessions like Clothes, furnishings, and also digital tools Curtains Washing machine and dryer Mobile a/c unit Microwave Carpets not consisted of in structure protection Prized possession things like artwork Flooding insurance policy does not generally cover various other sorts of water damage, like from a drain back-up that was not created by flooding.